Global Acrylic Monomer Market Comprehensive Study 2024

Global Acrylic Monomer Market: By Type (Acrylate, Acrylic Acids and Salts, Bisphenol Acrylics, Polyfunctional Acrylics, Fluorinated Acrylics, Acrylonitrile, Acrylamide and Methacrylamide, Malemide, Carbohydrate Monomers, and Others), By Application (Plastic, Adhesives and Sealants, Synthetic Resins, Acrylic Fibers, Building Materials, Fabrics, Acrylic Rubber, and Others), By End Users (Paints and Coatings, Building and Construction, Automotive, Consumer Goods, Packaging, Water Treatment, Marine, Aerospace, and Others); and By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa) – Historical & Forecast Period (2020-2035) Comprehensive Study 2024

- Published Month : July 2, 2024

- No. of pages: 180

- Overview

- Table of Content

- Scope of Study

Acrylic Monomer Market Overview:

Global Acrylic Monomer market size was valued at USD 8,850 Million in 2023 and is expected to reach USD 15,280 Million at a (CAGR) of XX% from 2023 to 2035.

An acrylic monomer is a small molecule characterized by the presence of one or more carbon-carbon double bonds (C=C) within its structure. These monomers are derived primarily from acrylic acid or methacrylic acid and serve as the foundational units for the formation of acrylic polymers.

Acrylic Monomer Market Growth Drivers:

- Increasing Demand in Paints and Coatings: Acrylic monomers are essential components in the formulation of paints, coatings, and varnishes due to their excellent weather resistance, durability, and color retention properties. The growing construction and automotive industries worldwide are driving the demand for acrylic-based coatings.

- Expansion in Adhesives and Sealants: Acrylic monomers play a crucial role in the adhesive and sealant industry, providing strong bonding capabilities and flexibility. The demand is driven by applications in the construction, packaging, automotive, and assembly industries.

Acrylic Monomer Market Trends:

- Demand for High-Performance Coatings: There is a growing demand for high-performance acrylic coatings that offer superior durability, weather resistance, and aesthetic appeal. These coatings are increasingly used in architectural, automotive, and industrial applications where durability and appearance are critical.

- Bio-Based and Sustainable Acrylic Monomers: There is increasing research and development focused on developing acrylic monomers from renewable, bio-based feedstocks. Bio-based acrylic monomers are gaining traction due to their potential to reduce dependence on fossil fuels and lower environmental impact.

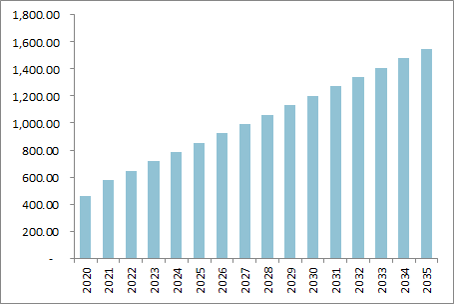

Global Acrylic Monomer Market Revenue (USD Million), (2020-2035)

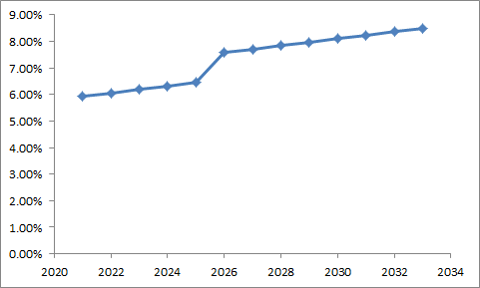

Global Acrylic Monomer Market YOY (%), (2020-2035)

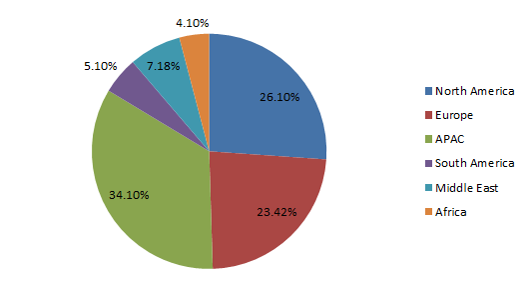

Global Acrylic Monomer Market by Regions Share (%), 2024

Top Acrylic Monomer Market Players Share (%), 2024

Study Coverage

| Metrics | Details |

| Years | 2020-2035 |

| Base Year | 2023 |

| Market Size | Revenue (USD Million) and Volume (K Tons) |

| Regions | North America – U.S, Canada, and Mexico Europe- Germany, France, United Kingdom, Italy, Spain, Netherlands, Poland, Belgium, Denmark and Rest of Europe APAC- China, Japan, India, South Korea, Taiwan, Vietnam, Singapore, Philippines, Australia, and Rest of Asia-Pacific Middle East- Kuwait, Saudi Arabia, Oman, Qatar, UAE, Egypt, and the Rest of the Middle East Africa- South Africa, Chad, Mali, Sudan, Algeria, and Rest of Africa |

| Segments | Product

Application

End Use

|

| Players | DHALOP CHEMICALS (India), B JOSHI AGROCHEM PHARMA (India), BASF SE (Germany), Arkema (France), Mitsubishi Chemical Group Corporation (Japan), DOW (U.S.), LG Chem (South Korea), Evonik Industries AG (Germany), NIPPON SHOKUBAI CO., LTD. (Japan), Bharat Petroleum Corporation Limited (India), Pallav Chemicals (India), Chirag Enterprise (India), LobaChemie Pvt Ltd. (India), Solvents (U.K.), and Tokyo Chemical Industries Co., Ltd. (Japan) |

Acrylic Monomer Insights

- Acrylic Monomer Market Revenue Size (USD Million)/Volume Size

- Acrylic Monomer Market Players Analysis

- Top 10 Buyers Details

- Acrylic Monomer Market Historical & Estimated Years (2020-2035)

- Acrylic Monomer Market Regional/Segment Analysis

- Acrylic Monomer Market Import/Export/Production Data

- 5 Successful Primary Validated Sources

- Acrylic Monomer Market Customization Options

- Post-sales Support

Global Acrylic Monomer Market: By Type (Acrylate, Acrylic Acids and Salts, Bisphenol Acrylics, Polyfunctional Acrylics, Fluorinated Acrylics, Acrylonitrile, Acrylamide and Methacrylamide, Malemide, Carbohydrate Monomers, and Others), By Application (Plastic, Adhesives and Sealants, Synthetic Resins, Acrylic Fibers, Building Materials, Fabrics, Acrylic Rubber, and Others), By End Users (Paints and Coatings, Building and Construction, Automotive, Consumer Goods, Packaging, Water Treatment, Marine, Aerospace, and Others); and By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa) – Historical & Forecast Period (2020-2035) Comprehensive Study 2024

1. Global Acrylic Monomer Market Outlook

2. Global Acrylic Monomer Market Executive Summary

2.1. Global Market Revenue Size (USD Million) and (K Tons) (2020-2035)

2.2. Key Trends By Segments (2020-2035)

2.3. Key Trends By Geography (2020-2035)

3. Global Acrylic Monomer Market Key Vendors Analysis

3.1. Regulatory Framework

3.2. New Business and Ease of Doing Business Index

3.3. Case Studies of Successful Key Ventures

3.4. Top Players Comparative Analysis

3.4.1. Country/Regions

3.4.2. Type

3.4.3. Applications

3.5. Key Vendors

3.5.1. Top 5 Vendors Pricing Analysis

3.5.2. Product Benchmarking

3.5.3. Future Investment Plans

3.6. Acrylic Monomer Market – Forces

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Challenges

3.6.3.1. Porter’s Five Forces Analysis

3.6.3.1.1. Bargaining Power of Suppliers

3.6.3.1.2. Bargaining Power of Buyers

3.6.3.1.3. Threat of New Entrants

3.6.3.1.4. Threat of Substitutes

3.6.3.1.5. Degree of Competition

4. Global Acrylic Monomer Market Revenue (USD Million) and Volume (K Tons) Size (2020-2035)- By Geographical Analysis

4.1. North America

4.1.1. U.S

4.1.2. Canada

4.1.3. Mexico

4.2. Europe

4.2.1. Germany

4.2.2. France

4.2.3. U.K

4.2.4. Italy

4.2.5. Spain

4.2.6. Netherlands

4.2.7. Poland

4.2.8. Belgium

4.2.9. Denmark

4.2.10. Rest of Europe

4.3. APAC

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. Taiwan

4.3.5. Vietnam

4.3.6. Philippines

4.3.7. Singapore

4.3.8. Australia

4.3.9. South Korea

4.3.10. Rest of APAC

4.4. South America

4.4.1. Brazil

4.4.2. Argentina

4.4.3. Peru

4.4.4. Colombia

4.4.5. Chile

4.4.6. Rest of South America

4.5. Middle East

4.5.1. Kuwait

4.5.2. Saudi Arabia

4.5.3. Oman

4.5.4. Qatar

4.5.5. UAE

4.5.6. Egypt

4.5.7. Rest of Middle East

4.6. Africa

4.6.1. South Africa

4.6.2. Chad

4.6.3. Mali

4.6.4. Sudan

4.6.5. Algeria

4.6.6. Rest of Africa

5. Global Acrylic Monomer Market Revenue (USD Million) and Volume (K Tons) Size (2020-2035)- By Type

5.1. Acrylate

5.2. Acrylic Acids and Salts

5.3. Bisphenol Acrylics

5.4. Polyfunctional Acrylics

5.5. Fluorinated Acrylics

5.6. Acrylonitrile

5.7. Acrylamide and Methacrylamide

5.8. Malemide

5.9. Carbohydrate Monomers

5.10. Others

6. Global Acrylic Monomer Market Revenue (USD Million) and Volume (K Tons) Size (2020-2035)- By Applications

6.1. Plastic

6.2. Adhesives and Sealants

6.3. Synthetic Resins

6.4. Acrylic Fibers

6.5. Building Materials

6.6. Fabrics

6.7. Acrylic Rubber

6.8. Others

7. Global Acrylic Monomer Market Revenue (USD Million) and Volume (K Tons) Size (2020-2035)- By End Users

7.1. Paints and Coatings

7.2. Building and Construction

7.3. Automotive

7.4. Consumer Goods

7.5. Packaging

7.6. Water Treatment

7.7. Marine

7.8. Aerospace

7.9. Others

8. Company Profile Analysis

8.1. BASF SE (Germany)

8.1.1. Vendors Overview

8.1.2. Business Portfolio

8.1.3. Geographical Portfolio

8.1.4. Customers

8.1.5. Financial Analysis

8.1.6. Recent Developments

8.2. DHALOP CHEMICALS (India)

8.3. B JOSHI AGROCHEM PHARMA (India)

8.4. Arkema (France)

8.5. Mitsubishi Chemical Group Corporation (Japan)

8.6. DOW (U.S.)

8.7. LG Chem (South Korea)

8.8. Evonik Industries AG (Germany)

8.9. NIPPON SHOKUBAI CO., LTD. (Japan)

8.10. Bharat Petroleum Corporation Limited (India)

8.11. Pallav Chemicals (India)

8.12. Chirag Enterprise (India)

8.13. LobaChemie Pvt Ltd. (India)

8.14. Solvents (U.K.)

8.15. Tokyo Chemical Industries Co., Ltd. (Japan)

8.16. Others

9. Sources Covered

9.1. Primary Sources

9.2. Secondary Sources

- By Type (Acrylate, Acrylic Acids and Salts, Bisphenol Acrylics, Polyfunctional Acrylics, Fluorinated Acrylics, Acrylonitrile, Acrylamide and Methacrylamide, Malemide, Carbohydrate Monomers, and Others)

- By Application (Plastic, Adhesives and Sealants, Synthetic Resins, Acrylic Fibers, Building Materials, Fabrics, Acrylic Rubber, and Others)

- By End Users (Paints and Coatings, Building and Construction, Automotive, Consumer Goods, Packaging, Water Treatment, Marine, Aerospace, and Others)

- By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa)