Global Contract Logistics Market Comprehensive Study 2024

Global Contract Logistics Market: By Mode of Transportation (Railways, Airways, Roadways and Waterways); By Type (Insourcing and Outsourcing); By Service (Transportation, Warehousing, Distribution, and Aftermarket Logistics); By End User (Aerospace, Automotive, Industrial, Food & Beverages, Pharma and Healthcare, Retail, E-Commerce and Others); and By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa) – Historical & Forecast Period (2020-2035) Comprehensive Study 2024

- Published Month : July 1, 2024

- No. of pages: 180

- Overview

- Table of Content

- Scope of Study

Contract Logistics Market Overview:

Global Contract Logistics market size was valued at USD 256,150 Million in 2023 and is expected to reach USD 495,600 Million at a (CAGR) of XX% from 2023 to 2030.

United States Contract Logistics Statistics

The United States Contract Logistics Market is expected to reach USD 135,806 Million in 2024 and grow at a CAGR of XX% to reach USD 170,250 Million by 2030.

In 2023, domestic transportation management solutions in the 3PL market in the United States were valued at USD 110,400 Million. This solution is projected to reach 186,500 Million U.S. dollars by 2030.

Contract logistics refers to the outsourcing of logistics activities and functions to a third-party logistics (3PL) provider through a contractual agreement. In this arrangement, the 3PL provider assumes responsibility for managing and executing various aspects of a company’s logistics operations, typically under long-term contractual agreements.

By outsourcing logistics functions to a contract logistics provider, companies can benefit from cost savings, improved efficiency, and access to specialized expertise, scalability, and flexibility to adapt to changing business needs. Contract logistics arrangements allow companies to focus on their core competencies while entrusting logistics operations to experienced professionals.

Contract Logistics Market Growth Drivers:

- Focus on Core Competencies: Companies are increasingly outsourcing non-core functions such as logistics to specialized providers to focus on their core competencies. Contract logistics providers offer expertise, infrastructure, and technology solutions to optimize supply chain operations, allowing companies to concentrate on product development, marketing, and customer service.

- Shift to Omni-channel Distribution: The rise of omni-channel retailing has led to increased complexity in supply chain management, as companies need to fulfill orders through multiple channels, including brick-and-mortar stores, e-commerce platforms, and mobile apps. Contract logistics providers offer integrated solutions to manage inventory across multiple channels, optimize order fulfillment processes, and provide seamless customer experiences.

Contract Logistics Market Trends:

- Value-added Services: Contract logistics providers are expanding their service offerings beyond traditional warehousing and transportation to include value-added services such as packaging, labelling, kitting, customization, and reverse logistics. These value-added services help differentiate providers in a competitive market and provide additional value to customers.

Collaborative Partnerships: Contract logistics providers are forming strategic partnerships and alliances with other companies in the logistics ecosystem, including technology providers, transportation carriers, and warehousing specialists, to enhance service offerings, expand geographical reach, and drive innovation in the industry.

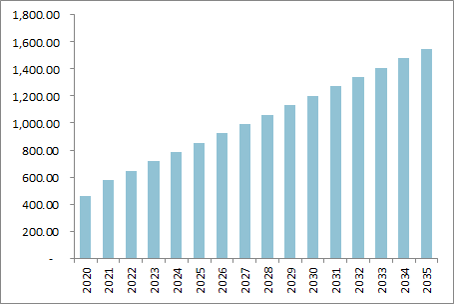

Global Contract Logistics Market Revenue (USD Million), (2020-2035)

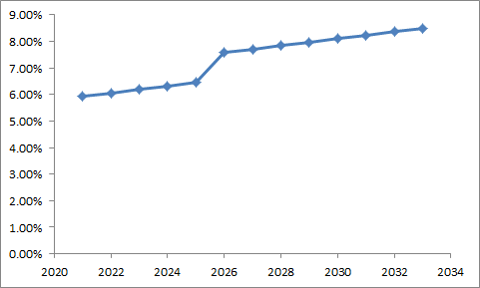

Global Contract Logistics Market YOY (%), (2020-2035)

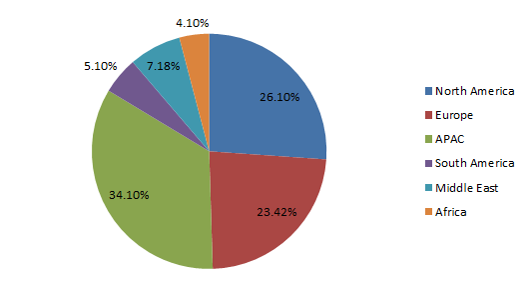

Global Contract Logistics by Regions Share (%), 2024

Top Contract Logistics Market Players Share (%), 2024

Study Coverage

| Metrics | Details |

| Years | 2020-2035 |

| Base Year | 2023 |

| Market Size | Revenue (USD Million) and Volume (Metric Tons) |

| Regions | North America – U.S, Canada and Mexico Europe- Germany, France, United Kingdom, Italy, Spain, Netherlands, Poland, Belgium, Denmark and Rest of Europe APAC- China, Japan, India, South Korea, Taiwan, Vietnam, Singapore, Philippines, Australia, and Rest of Asia-Pacific Middle East- Kuwait, Saudi Arabia, Oman, Qatar, UAE, Egypt, and Rest of Middle East Africa- South Africa, Chad, Mali, Sudan, Algeria, and Rest of Africa |

| Segments | By Mode of Transportation – Railways, Airways, Roadways and Waterways

By Type – Insourcing and Outsourcing By Service – Transportation, Warehousing, Distribution, and Aftermarket Logistics By End User – Aerospace, Automotive, Industrial, Food & Beverages, Pharma and Healthcare, Retail, E-Commerce and Others |

| Players | Hellmann Worldwide Logistics, DB Schenker, United Parcel Service of America, Inc., Neovia Logistics Services, LLC., LOGISTEED, Ltd., CEVA LOGISTICS, DSV, GEODIS, Ryder System, Inc., CJ Logistics Corporation, Kuehne Nagel, Penske, Agility, Deutsche Post AG, A.P. Moller – Maersk, XPO Logistics Inc., Yusen Logistics Co., Ltd. and Others |

Contract Logistics Insights

- Contract Logistics Market Revenue Size (USD Million)/Volume Size

- Contract Logistics Market Players Analysis

- Top 10 Buyers Details

- Contract Logistics Market Historical & Estimated Years (2020-2035)

- Contract Logistics Market Regional/Segments Analysis

- Contract Logistics Market Import/Export/Production Data

- 5 Successful Primary validated Sources

- Contract Logistics Market Customization Options

- Post-sales Support

Global Contract Logistics Market: By Mode of Transportation (Railways, Airways, Roadways and Waterways); By Type (Insourcing and Outsourcing); By Service (Transportation, Warehousing, Distribution, and Aftermarket Logistics); By End User (Aerospace, Automotive, Industrial, Food & Beverages, Pharma and Healthcare, Retail, E-Commerce and Others); and By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa) – Historical & Forecast Period (2020-2035) Comprehensive Study 2024

1. Global Contract Logistics Market Outlook

2. Global Contract Logistics Market Executive Summary

2.1. Global Market Revenue Size (USD Million) (2020-2035)

2.2. Key Trends By Segments (2020-2035)

2.3. Key Trends By Geography (2020-2035)

3. Global Contract Logistics Market Key Vendors Analysis

3.1. Regulatory Framework

3.2. New Business and Ease of Doing Business Index

3.3. Case Studies of Successful Key Ventures

3.4. Top Players Comparative Analysis

3.4.1. Country/Regions

3.4.2. Type

3.4.3. End-Users

3.5. Key Vendors

3.5.1. Top 5 Vendors Pricing Analysis

3.5.2. Product Benchmarking

3.5.3. Future Investment Plans

3.6. Contract Logistics Market – Forces

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Challenges

3.6.3.1. Porter’s Five Forces Analysis

3.6.3.1.1. Bargaining Power of Suppliers

3.6.3.1.2. Bargaining Power of Buyers

3.6.3.1.3. Threat of New Entrants

3.6.3.1.4. Threat of Substitutes

3.6.3.1.5. Degree of Competition

4. Global Contract Logistics Market Revenue (USD Million) Size (2020-2035)- By Geographical Analysis

4.1. North America

4.1.1. US

4.1.2. Canada

4.1.3. Mexico

4.2. Europe

4.2.1. Germany

4.2.2. France

4.2.3. UK

4.2.4. Italy

4.2.5. Spain

4.2.6. Netherlands

4.2.7. Poland

4.2.8. Belgium

4.2.9. Denmark

4.2.10. Rest of Europe

4.3. APAC

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. Taiwan

4.3.5. Vietnam

4.3.6. Philippines

4.3.7. Singapore

4.3.8. Australia

4.3.9. South Korea

4.3.10. Rest of APAC

4.4. South America

4.4.1. Brazil

4.4.2. Argentina

4.4.3. Peru

4.4.4. Colombia

4.4.5. Chile

4.4.6. Rest of South America

4.5. Middle East

4.5.1. Kuwait

4.5.2. Saudi Arabia

4.5.3. Oman

4.5.4. Qatar

4.5.5. UAE

4.5.6. Egypt

4.5.7. Rest of Middle East

4.6. Africa

4.6.1. South Africa

4.6.2. Chad

4.6.3. Mali

4.6.4. Sudan

4.6.5. Algeria

4.6.6. Rest of Africa

5. Global Contract Logistics Market Revenue (USD Million) Size (2020-2035)- By Mode of Transportation

5.1. Railways

5.2. Airways

5.3. Roadways

5.4. Waterways

6. Global Contract Logistics Market Revenue (USD Million) Size (2020-2035)- By Type

6.1. Insourcing

6.2. Outsourcing

7. Global Contract Logistics Market Revenue (USD Million) Size (2020-2035)- By Service

7.1. Transportation

7.2. Warehousing

7.3. Distribution

7.4. Aftermarket Logistics

8. Global Contract Logistics Market Revenue (USD Million) Size (2020-2035)- By End User

8.1. Aerospace

8.2. Automotive

8.3. Industrial

8.4. Food & Beverages

8.5. Pharma and Healthcare

8.6. Retail

8.7. E-Commerce

8.8. Others

9. Company Profile Analysis

9.1. A.P. Moller – Maersk

9.1.1. Vendors Overview

9.1.2. Business Portfolio

9.1.3. Geographical Portfolio

9.1.4. Customers

9.1.5. Financial Analysis

9.1.6. Recent Developments

9.2. Agility

9.3. CEVA Logistics AG

9.4. CJ Logistics Corporation

9.5. DB Schenker

9.6. Deutsche Post AG

9.7. DSV

9.8. GEODIS

9.9. Hellmann Worldwide Logistics

9.10. Logisteed, Ltd.

9.11. Kuehne+Nagel International AG

9.12. Neovia Logistics Services, LLC

9.13. Penske

9.14. Ryder System, Inc.

9.15. United Parcel Service, Inc. (UPS)

9.16. XPO Logistics, Inc.

9.17. Yusen Logistics Co., Ltd.

9.18. Others

10. Sources Covered

10.1. Primary Sources

10.2. Secondary Sources

- Mode of Transportation (Railways, Airways, Roadways and Waterways)

- Type (Insourcing and Outsourcing)

- Service (Transportation, Warehousing, Distribution, and Aftermarket Logistics)

- End User (Aerospace, Automotive, Industrial, Food & Beverages, Pharma and Healthcare, Retail, E-Commerce and Others)

- Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa)