Global AdBlue Market Comprehensive Study 2024

Global AdBlue Market: By Method (Pre Combustion, and Post Combustion); By Packaging (Cans, Tanks, Drums, and Bulk); By Application (Commercial Vehicles, Non road mobile machines, Cars and passenger Vehicles, Railways, and Others); and By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa) – Historical & Forecast Period (2020-2035) Comprehensive Study 2024

- Published Month : July 1, 2024

- No. of pages: 180

- Overview

- Table of Content

- Scope of Study

AdBlue Market Overview:

Global AdBlue market size was valued at USD 34,200.60 Million in 2023 and is expected to reach USD 70,200.15 Million at a (CAGR) of XX% from 2023 to 2035.

AdBlue: An Essential Component for Reducing Emissions in Diesel Engines

AdBlue, also known as Diesel Exhaust Fluid (DEF), is a crucial element in reducing emissions from diesel engines. It is a high-purity urea solution that plays a key role in the Selective Catalytic Reduction (SCR) process, a technology used to lower nitrogen oxide (NOx) emissions from diesel vehicles. This article explores the composition, functioning, benefits, and challenges associated with AdBlue.

Composition and Functioning

AdBlue is composed of 32.5% high-purity urea and 67.5% deionized water. When injected into the exhaust stream of a diesel engine, it undergoes a chemical reaction within the SCR catalyst. This reaction converts harmful NOx gases into harmless nitrogen and water vapor. The process can be summarized as follows:

- Injection: AdBlue is injected into the exhaust gases.

- Decomposition: At high temperatures, AdBlue decomposes into ammonia (NH3) and carbon dioxide (CO2).

- Reduction: The ammonia reacts with NOx in the SCR catalyst, reducing it to nitrogen (N2) and water (H2O).

Benefits of AdBlue

- Environmental Impact: The primary advantage of using AdBlue is the significant reduction in NOx emissions, which are major contributors to air pollution and respiratory problems. By converting NOx into benign nitrogen and water, AdBlue helps diesel engines meet stringent emission standards set by environmental regulations.

- Fuel Efficiency: Vehicles equipped with SCR systems can achieve better fuel efficiency. This is because the engine can be tuned for optimal performance and lower particulate emissions, with the SCR system handling NOx reduction.

- Compliance with Regulations: AdBlue enables diesel vehicles to comply with various emission standards, such as Euro 6 in Europe and Tier 4 in the United States. Compliance with these standards is essential for manufacturers to market their vehicles in different regions.

Challenges and Considerations

- Storage and Handling: AdBlue is sensitive to temperature and must be stored between -11°C and 30°C to maintain its effectiveness. It also has a limited shelf life, typically around one year, requiring proper inventory management.

- Infrastructure: The widespread adoption of AdBlue necessitates an extensive network of refilling stations. While infrastructure is well-developed in many regions, it can be a challenge in remote or less developed areas.

- Cost: The production and distribution of AdBlue add to the operational costs for vehicle owners. However, these costs are often offset by the benefits of improved fuel efficiency and compliance with emission standards.

Conclusion

AdBlue is an essential component in the fight against air pollution from diesel engines. Its role in the SCR process helps reduce harmful NOx emissions, contributing to cleaner air and compliance with environmental regulations. Despite challenges related to storage, infrastructure, and costs, the benefits of using AdBlue make it a vital element in modern diesel technology. As emission standards continue to evolve, the importance of AdBlue and similar technologies will only increase in the pursuit of a greener and more sustainable future.

AdBlue Market Growth Drivers:

- Increasing Diesel Vehicle Sales: Despite the rise of electric vehicles, diesel engines remain popular in many sectors such as commercial transportation (trucks, buses) and agriculture due to their efficiency and torque characteristics. As the sales of diesel vehicles grow, so does the demand for AdBlue.

- Expansion of SCR Technology: Selective Catalytic Reduction (SCR) technology, which utilizes AdBlue, continues to advance. Manufacturers are improving SCR systems to be more efficient, reliable, and integrated into diesel engines, further driving the demand for AdBlue.

- Global Market Expansion: The adoption of AdBlue is not limited to Europe but is also growing in North America, Asia-Pacific, and other regions as they implement stricter emission standards and diesel engine regulations.

AdBlue Market Trends:

- Shift Towards Diesel Hybridization: Diesel engines paired with hybrid technology are gaining popularity as automakers seek to balance efficiency with lower emissions. Hybrid diesel vehicles often utilize AdBlue to meet emission standards while optimizing fuel efficiency.

- Technological Advancements in SCR Systems: Continuous improvements in Selective Catalytic Reduction (SCR) technology are enhancing the efficiency and reliability of AdBlue systems. Manufacturers are focusing on reducing AdBlue consumption, optimizing SCR catalyst performance, and integrating systems seamlessly into vehicles.

- Market Consolidation and Strategic Partnerships: The AdBlue market is witnessing consolidation as major players expand their market presence through mergers, acquisitions, and strategic partnerships. This trend aims to strengthen supply chain capabilities, enhance distribution networks, and broaden product offerings.

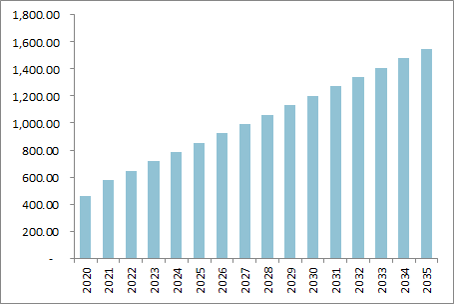

Global AdBlue Market Revenue (USD Million), (2020-2035)

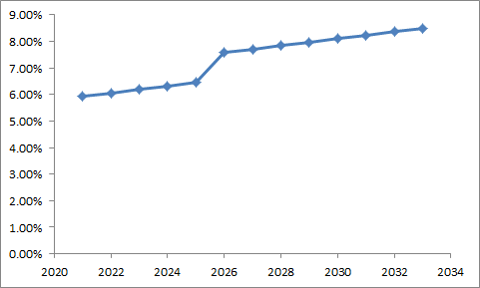

Global AdBlue Market YOY (%), (2020-2035)

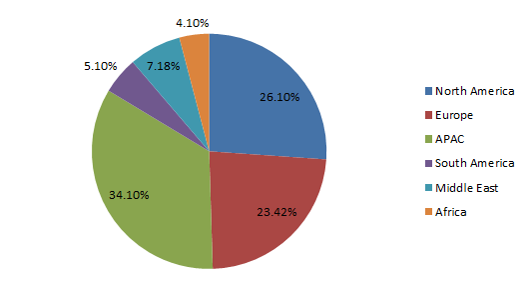

Global AdBlue Market by Regions Share (%), 2024

Top AdBlue Market Players Share (%), 2024

Study Coverage

| Metrics | Details |

| Years | 2020-2035 |

| Base Year | 2023 |

| Market Size | Revenue (USD Million) and Volume (Million Liters) |

| Regions | North America – U.S, Canada and Mexico Europe- Germany, France, United Kingdom, Italy, Spain, Netherlands, Poland, Belgium, Denmark and Rest of Europe APAC- China, Japan, India, South Korea, Taiwan, Vietnam, Singapore, Philippines, Australia, and Rest of Asia-Pacific Middle East- Kuwait, Saudi Arabia, Oman, Qatar, UAE, Egypt, and Rest of Middle East Africa- South Africa, Chad, Mali, Sudan, Algeria, and Rest of Africa |

| Segments | By Method

Pre Combustion Post Combustion By Packaging Cans Tanks Drums Bulk By Application Commercial Vehicles Non road mobile machines Cars and passenger Vehicles Railways Others |

| Players | BASF SE, CrossChem, Yara, Shell plc, Nissan Chemical Corporation, TotalEnergies, Cummins Inc., Mitsui Chemicals India Pvt. Ltd., CF Industries Holdings, Inc. and Bharat Petroleum Corporation Ltd., Chevron, Exxon Mobil Corporation, Sinopec, Mitsubishi Chemical, EcoBlue, Hyundai Xteer, TerraCair and BlueDEF |

AdBlue Insights

- AdBlue Market Revenue Size (USD Million)/Volume Size

- AdBlue Market Players Analysis

- Top 10 Buyers Details

- AdBlue Market Historical & Estimated Years (2020-2035)

- AdBlue Market Regional/Segments Analysis

- AdBlue Market Import/Export/Production Data

- 5 Successful Primary Validated Sources

- AdBlue Market Customization Options

- Post-sales Support

Global AdBlue Market: By Method (Pre Combustion, and Post Combustion); By Packaging (Cans, Tanks, Drums, and Bulk); By Application (Commercial Vehicles, Non road mobile machines, Cars and passenger Vehicles, Railways, and Others); and By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa) – Historical & Forecast Period (2020-2035) Comprehensive Study 2024

1. Global AdBlue Market Outlook

2. Global AdBlue Market Executive Summary

2.1. Global Market Revenue Size (USD Million) (2020-2035)

2.2. Key Trends By Segments (2020-2035)

2.3. Key Trends By Geography (2020-2035)

3. Global AdBlue Market Key Vendors Analysis

3.1. Regulatory Framework

3.2. New Business and Ease of Doing Business Index

3.3. Case Studies of Successful Key Ventures

3.4. Top Players Comparative Analysis

3.4.1. Country/Regions

3.4.2. Services

3.4.3. End-Users

3.5. Key Vendors

3.5.1. Top 5 Vendors Pricing Analysis

3.5.2. Product Benchmarking

3.5.3. Future Investment Plans

3.6. AdBlue Market – Forces

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Challenges

3.6.3.1. Porter’s Five Forces Analysis

3.6.3.1.1. Bargaining Power of Suppliers

3.6.3.1.2. Bargaining Power of Buyers

3.6.3.1.3. Threat of New Entrants

3.6.3.1.4. Threat of Substitutes

3.6.3.1.5. Degree of Competition

4. Global AdBlue Market Revenue (USD Million) and Volume (Million Liters) Size (2020-2035)- By Geographical Analysis

4.1. North America

4.1.1. U.S

4.1.2. Canada

4.1.3. Mexico

4.2. Europe

4.2.1. Germany

4.2.2. France

4.2.3. U.K

4.2.4. Italy

4.2.5. Spain

4.2.6. Netherlands

4.2.7. Poland

4.2.8. Belgium

4.2.9. Denmark

4.2.10. Rest of Europe

4.3. APAC

4.3.1. China

4.3.2. India

4.3.3. Japan

4.3.4. Taiwan

4.3.5. Vietnam

4.3.6. Philippines

4.3.7. Singapore

4.3.8. Australia

4.3.9. South Korea

4.3.10. Rest of APAC

4.4. South America

4.4.1. Brazil

4.4.2. Argentina

4.4.3. Peru

4.4.4. Colombia

4.4.5. Chile

4.4.6. Rest of South America

4.5. Middle East

4.5.1. Kuwait

4.5.2. Saudi Arabia

4.5.3. Oman

4.5.4. Qatar

4.5.5. UAE

4.5.6. Egypt

4.5.7. Rest of Middle East

4.6. Africa

4.6.1. South Africa

4.6.2. Chad

4.6.3. Mali

4.6.4. Sudan

4.6.5. Algeria

4.6.6. Rest of Africa

5. Global AdBlue Market Revenue (USD Million) and Volume (Million Liters) Size (2020-2035)- By Method

5.1. Pre Combustion

5.2. Post Combustion

6. Global AdBlue Market Revenue (USD Million) and Volume (Million Liters) Size (2020-2035)- By Packaging

6.1. Cans

6.2. Tanks

6.3. Drums

6.4. Bulk

7. Global AdBlue Market Revenue (USD Million) and Volume (Million Liters) Size (2020-2035)- By Applications

7.1. Commercial Vehicles

7.2. Non road mobile machines

7.3. Cars and passenger Vehicles

7.4. Railways

7.5. Others

8. Company Profile Analysis

8.1. BASF SE

8.1.1. Vendors Overview

8.1.2. Business Portfolio

8.1.3. Geographical Portfolio

8.1.4. Customers

8.1.5. Financial Analysis

8.1.6. Recent Developments

8.2. CrossChem

8.3. Yara, Shell plc

8.4. Nissan Chemical Corporation

8.5. TotalEnergies

8.6. Cummins Inc.

8.7. Mitsui Chemicals India Pvt. Ltd.

8.8. CF Industries Holdings, Inc. and

8.9. Bharat Petroleum Corporation Ltd.

8.10. Chevron

8.11. Exxon Mobil Corporation

8.12. Sinopec, Mitsubishi Chemical

8.13. EcoBlue

8.14. Hyundai Xteer

8.15. TerraCair

8.16. BlueDEF

8.17. Others

9. Sources Covered

9.1. Primary Sources

9.2. Secondary Sources

- By Method (Pre Combustion, and Post Combustion)

- By Packaging (Cans, Tanks, Drums, and Bulk)

- By Application (Commercial Vehicles, Non road mobile machines, Cars and passenger Vehicles, Railways, and Others)

- By Regions (North America, Europe, Asia-Pacific, South America, Middle East & Africa